All Categories

Featured

Table of Contents

- – Who provides the most reliable Income Protecti...

- – Why is an Annuity Investment important for my ...

- – What are the benefits of having an Long-term ...

- – What are the tax implications of an Secure An...

- – What are the benefits of having an Retiremen...

- – What are the top Long-term Care Annuities pr...

Note, nevertheless, that this doesn't state anything concerning readjusting for inflation. On the plus side, even if you assume your option would certainly be to buy the stock exchange for those 7 years, and that you would certainly obtain a 10 percent annual return (which is much from certain, specifically in the coming years), this $8208 a year would certainly be greater than 4 percent of the resulting small stock worth.

Example of a single-premium deferred annuity (with a 25-year deferral), with 4 repayment alternatives. The regular monthly payment right here is highest possible for the "joint-life-only" alternative, at $1258 (164 percent higher than with the immediate annuity).

The method you purchase the annuity will figure out the answer to that inquiry. If you get an annuity with pre-tax bucks, your premium minimizes your taxable income for that year. According to , getting an annuity inside a Roth strategy results in tax-free payments.

Who provides the most reliable Income Protection Annuities options?

The advisor's very first step was to create a thorough economic strategy for you, and then clarify (a) how the proposed annuity fits right into your total plan, (b) what choices s/he considered, and (c) just how such options would or would certainly not have caused lower or greater compensation for the expert, and (d) why the annuity is the exceptional option for you. - Tax-efficient annuities

Obviously, an expert may attempt pressing annuities also if they're not the most effective fit for your scenario and objectives. The reason might be as benign as it is the only product they sell, so they drop prey to the proverbial, "If all you have in your tool kit is a hammer, pretty quickly whatever starts appearing like a nail." While the consultant in this circumstance might not be dishonest, it increases the risk that an annuity is a poor option for you.

Why is an Annuity Investment important for my financial security?

Considering that annuities frequently pay the representative offering them a lot higher payments than what s/he would certainly receive for spending your money in common funds - Retirement annuities, not to mention the no commissions s/he 'd get if you invest in no-load mutual funds, there is a huge reward for agents to push annuities, and the much more complex the far better ()

An underhanded expert suggests rolling that quantity right into brand-new "much better" funds that just take place to lug a 4 percent sales load. Accept this, and the consultant pockets $20,000 of your $500,000, and the funds aren't likely to carry out far better (unless you chose even extra poorly to start with). In the very same example, the expert might steer you to acquire a complicated annuity with that $500,000, one that pays him or her an 8 percent commission.

The consultant hasn't figured out how annuity payments will certainly be strained. The advisor hasn't revealed his/her payment and/or the costs you'll be charged and/or hasn't shown you the influence of those on your eventual repayments, and/or the compensation and/or fees are unacceptably high.

Your family history and present wellness point to a lower-than-average life expectations (Annuities). Existing rate of interest, and hence predicted settlements, are traditionally low. Also if an annuity is ideal for you, do your due persistance in comparing annuities sold by brokers vs. no-load ones sold by the providing business. The latter might require you to do even more of your very own study, or utilize a fee-based financial advisor that may receive payment for sending you to the annuity company, yet may not be paid a greater compensation than for various other financial investment choices.

What are the benefits of having an Long-term Care Annuities?

The stream of month-to-month payments from Social Safety and security is similar to those of a deferred annuity. Because annuities are voluntary, the people acquiring them normally self-select as having a longer-than-average life span.

Social Safety and security benefits are totally indexed to the CPI, while annuities either have no inflation security or at many provide a set portion yearly increase that may or may not make up for inflation in full. This kind of biker, just like anything else that boosts the insurance company's danger, requires you to pay even more for the annuity, or accept lower payments.

What are the tax implications of an Secure Annuities?

Disclaimer: This short article is planned for informative purposes only, and ought to not be considered monetary suggestions. You ought to speak with an economic specialist prior to making any type of major economic choices.

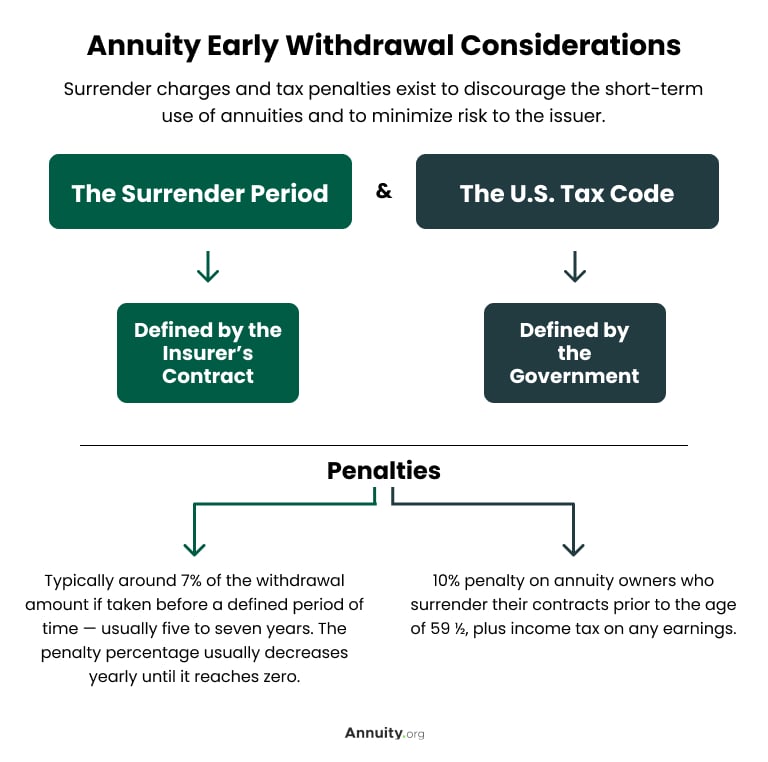

Given that annuities are intended for retirement, taxes and charges may use. Principal Protection of Fixed Annuities.

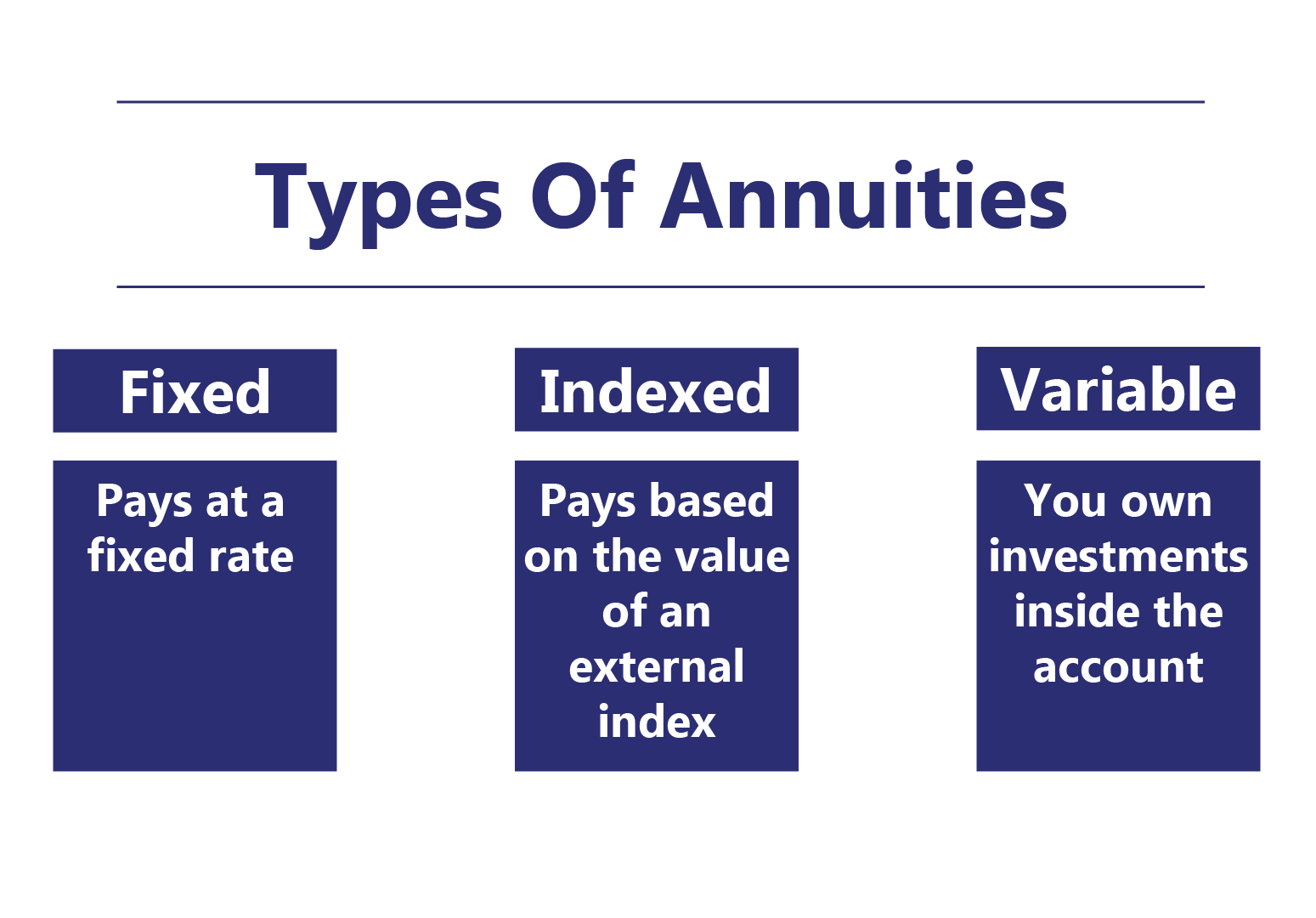

Immediate annuities. Made use of by those that want reliable revenue promptly (or within one year of acquisition). With it, you can customize revenue to fit your demands and produce income that lasts permanently. Deferred annuities: For those that wish to grow their cash with time, yet want to defer accessibility to the cash until retired life years.

What are the benefits of having an Retirement Annuities?

Variable annuities: Supplies higher capacity for development by spending your money in investment options you select and the capability to rebalance your portfolio based upon your choices and in a manner that straightens with altering financial objectives. With repaired annuities, the business invests the funds and offers a rate of interest to the client.

When a fatality claim accompanies an annuity, it is vital to have a named recipient in the contract. Various choices exist for annuity survivor benefit, relying on the contract and insurance company. Choosing a refund or "period specific" choice in your annuity gives a survivor benefit if you die early.

What are the top Long-term Care Annuities providers in my area?

Calling a beneficiary various other than the estate can help this process go much more efficiently, and can help ensure that the earnings go to whoever the specific wanted the cash to go to instead than going through probate. When present, a fatality benefit is automatically included with your contract.

Table of Contents

- – Who provides the most reliable Income Protecti...

- – Why is an Annuity Investment important for my ...

- – What are the benefits of having an Long-term ...

- – What are the tax implications of an Secure An...

- – What are the benefits of having an Retiremen...

- – What are the top Long-term Care Annuities pr...

Latest Posts

Analyzing Fixed Income Annuity Vs Variable Annuity A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Choosing the R

Analyzing Variable Annuities Vs Fixed Annuities Everything You Need to Know About Financial Strategies Defining Pros And Cons Of Fixed Annuity And Variable Annuity Pros and Cons of Various Financial O

Highlighting Fixed Index Annuity Vs Variable Annuities Everything You Need to Know About Financial Strategies What Is Fixed Income Annuity Vs Variable Annuity? Pros and Cons of Fixed Annuity Vs Equity

More

Latest Posts